On Your Side Since 1894

Provident Loan continues to serve people and small businesses with short-term, collateral loans for gold, jewelry, fine watches, and silverware, at rates much lower than traditional pawnshops.

About The Provident Loan Society of New York

Our History & Founding

48 philanthropically-minded New Yorkers including Solomon Loeb, Alfred B. Mason, J.P. Morgan, Jacob H. Schiff, Gustav H. Schwab, and Cornelius Vanderbilt founded The Provident Loan Society in response to the financial Panic of 1893. These dignitaries established a not-for-profit organization dedicated to providing low-interest short term loans to individuals upon pledge of property, giving people in financial need a respectful and dignified alternative to high cost pawnbrokers.

Helping Small Business Owners & Working Class Citizens of New York

Provident Loan was authorized by the State Legislature on April 13, 1894, and opened its doors five weeks later. Then as now, new immigrants and those without the means to establish a traditional banking relationship had few options for obtaining short term credit; many fell victim to predatory loan sharks. The Society’s founders, many of them bankers, recognized that banks were not serving small businessmen and the working poor. Encouraged by the Charity Organization Society of the City of New York, and over the vigorous objections of pawnbrokers, they persuaded the legislature to grant them a charter.

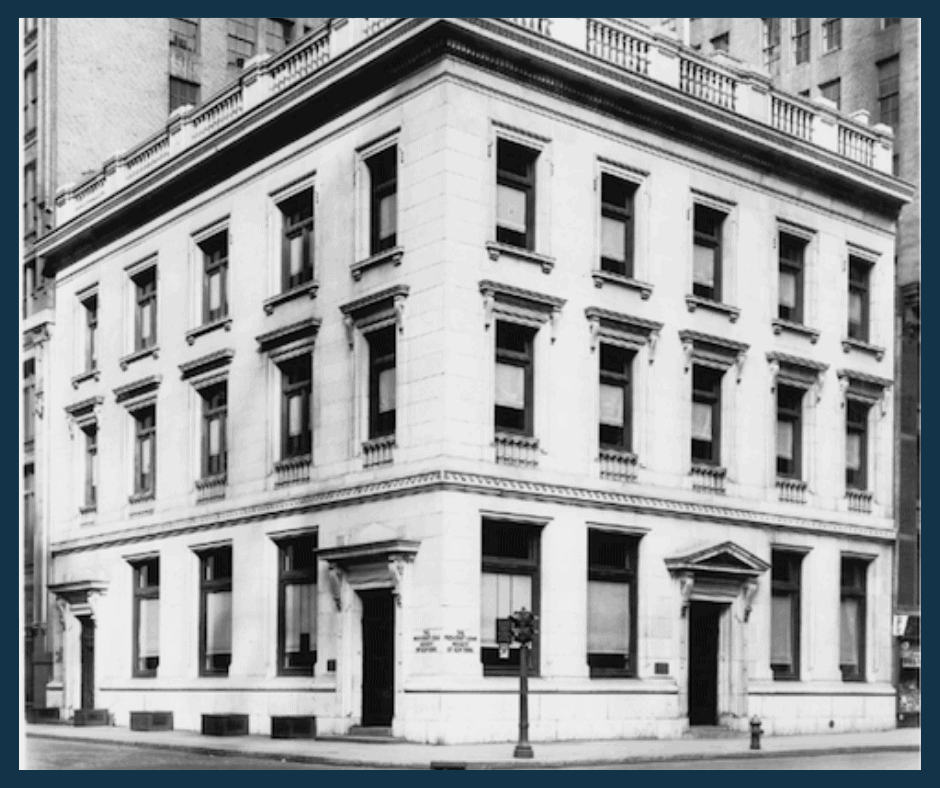

In 1909, the main branch opened on Fourth Avenue (now Park Avenue South) and 25th Street, where Provident Loan is still headquartered today.

The Provident Loan Society branch on Grand Street in 1944.

Behind the customer counter in the loan office at 346 Park Avenue. (Picture 1928)

A Non-Profit Social Service Organization

Providing Low-Cost Collateral Loans to Those in Need

Since then, the Society, operating as not-for-profit social service organization, has served its original purpose of making small loans available based on pledged collateral, at rates significantly less than those charged by pawnshops. (The few pledges not redeemed are auctioned and the net proceeds remanded to the consignors.) By the 1920s, the Society was making loans of about $30 million per year, to half a million individuals, or about one in twenty New Yorkers. The neighborhoods and community groups most in need of service have varied over the years, starting with the immigrant populations of the lower east side in the 1890s, and spreading to the upper east side during the Great Depression, to the Bronx today, but the Society’s commitment to providing dignified and businesslike short terms loans to people unable to qualify for bank loans, has never varied.

We Started in New York, Now We Offer Online-Loans Nationwide

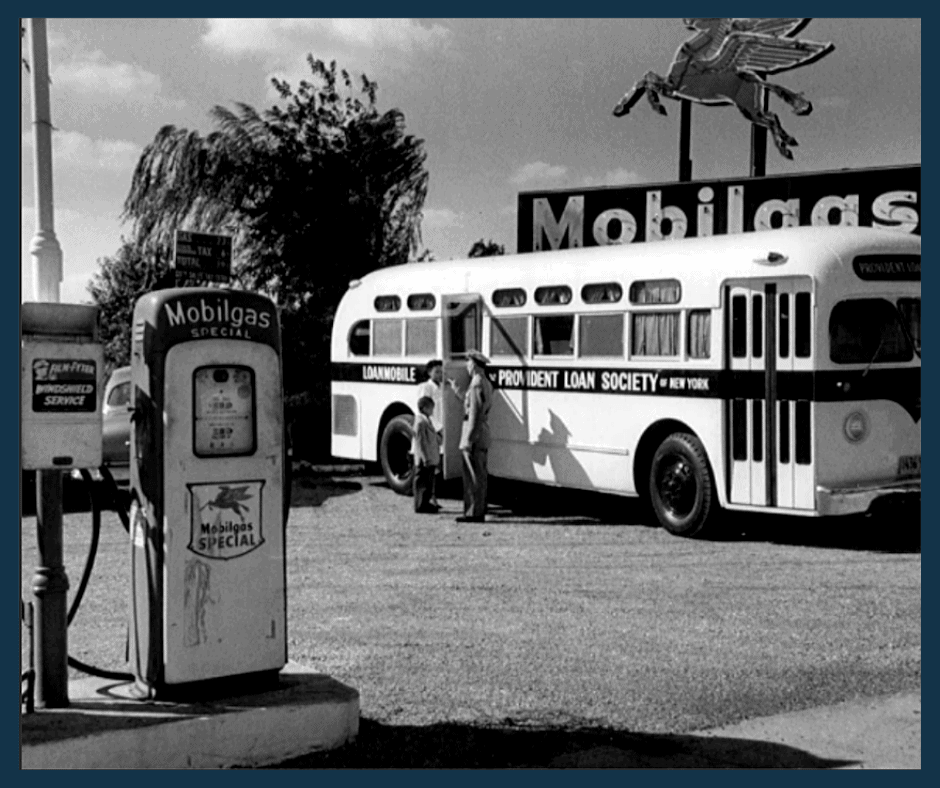

The Society has adapted to the changing needs of the population it seeks to serve. In the 1950s, a peripatetic LoanMobile drove to neighborhoods without a branch and offered on- the-spot loans. Today, the Society’s website provides nationwide access to its loan services. The Society also extends interest-free loans to federal employees affected by government shutdowns, and reduced-rates loans to active-duty military personnel, among other things. As PLS continues its second century of service, it seeks to reach as many people as possible, and to adapt and expand to changing conditions.

The Lenox Hill Office at 180 East 72nd Street was built originally for the 19th Ward Bank by William Ralph Emerson, a cousin of Ralph Waldo Emerson. (Picture 1951)

In the 1950s, a peripatetic LoanMobile drove to the neighborhoods without a branch and offered on the spot loans.

The first branch PLS opened, five years after its founding, was on Eldridge St (corner of Eldridge and Rivington Streets) on the Lower East Side, in the University Settlement Society house. This office was established in 1899 and moved to the East Houston Street location in 1940.